The FCA introduced the Consumer Duty initiative to bring about a fairer, more consumer-focused and level playing field in the Financial Services Market.

They expect firms to place customers’ interests at the centre of their businesses and to focus on the delivery of good customer outcomes.

Below are all the latest Consumer Duty updates that lenders need to be aware of:

Latest update: Digital Design in Online Journeys & Customer Outcomes

The FCA recently carried out a review to establish how firms acquire customers through their digital channels and how they are delivering good customer outcomes, in line with the requirements of Consumer Duty.

Summary of key findings:

-

The main finding from their review was that the design of digital platforms can both influence a customer’s behaviour in a specific direction, and their understanding of products and features.

-

What this means is:

-

Design can be an enabler of good consumer outcomes,

-

But, if not handled well, design can also drive customers toward making quick or ill-informed decisions that may not be in their best interests, or consistent with the FCA’s Consumer Duty expectations.

-

Consequently, the FCA is encouraging firms to consider customer understanding and decision making in their design of customer journeys, with a view to making any changes to existing processes where necessary.

Detailed look at the review

The FCA’s review covered the following 4 focus areas:

-

Design aspects

-

Customer groups

-

Testing and quality assurance

-

Management information and oversight

Design aspects

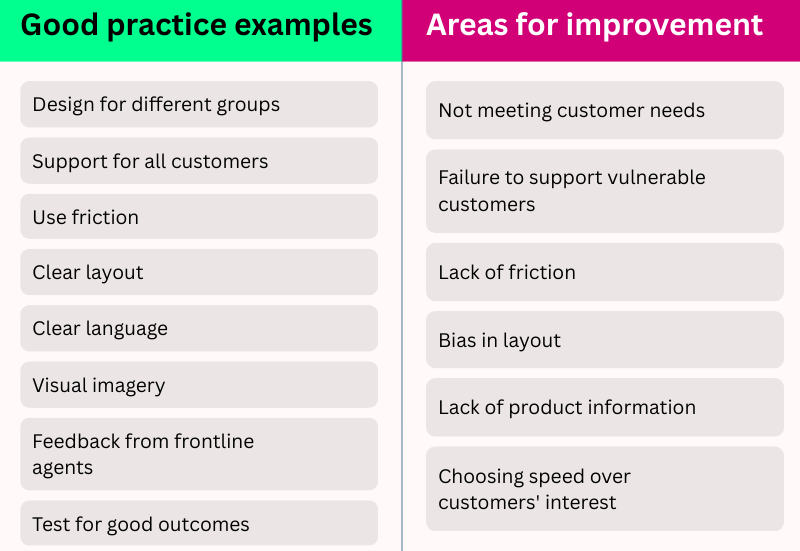

Recommendations for design aspects good practice:

-

Design digital journeys that meet the needs of different customer groups identified within the firm’s target market.

-

Ensure that adequate levels of support are provided to all customers, including those with characteristics of vulnerability.

-

Consider whether adding friction can help customers with their decisions and how it may affect customer choice.

-

Ensure a clear layout of product offerings that illustrate key features. Ensure customers are aware of the different steps within a journey before the sign-up process.

-

Use plain English and short sentences to aid understanding.

-

Use images and add videos to the digital journey, to help explain key information about products and how they work.

-

Include frontline agents in the design of digital journeys and support, allowing them to provide feedback based on real customer interactions.

-

Testing and quality assurance ensure good customer outcomes. Consider how the speed of digital journeys and timeliness of key information affect outcomes in your testing.

Intuitive by design, supportive by nature

Best practice built into every Lenvi PF1 experience.

Customer groups

A firm’s target market is likely to include a range of customers with a variety of needs and characteristics. There are also a range of circumstances that can impact a customer’s understanding of products and services, such as financial literacy.

The FCA’s feedback on this matter focused on firms being required to understand these needs and characteristics, and the objectives of customers in the target markets, and use this knowledge to inform the design of product and customer journeys.

In this regard, they set out the following descriptors of best practice:

-

Understand your target market - Target market analysis can help firms to better understand the different needs of customer groups, including the needs of customers acquired through different channels, those who need additional support, and those with characteristics of vulnerability.

-

Adequate support for all customers - Firms operating solely through a digital platform who make sure they can meet their customers' support needs. This includes ensure customers dealing with non-standard issues, with characteristics of vulnerability, and customers acquired through different channels, such as third-party referrals, are given more support to understand products and services.

-

Identify vulnerable customers - Firms can identify customers with characteristics of vulnerability and those requiring additional support through digital channels. Firms can review the effectiveness of their support channels through testing activity and customer insights.

Testing and quality assurance

Already alluded to earlier in the review, testing and quality assurance is a key area for ensuring that digital design of customer journeys is fit for purpose and meets the requirement of Consumer Duty.

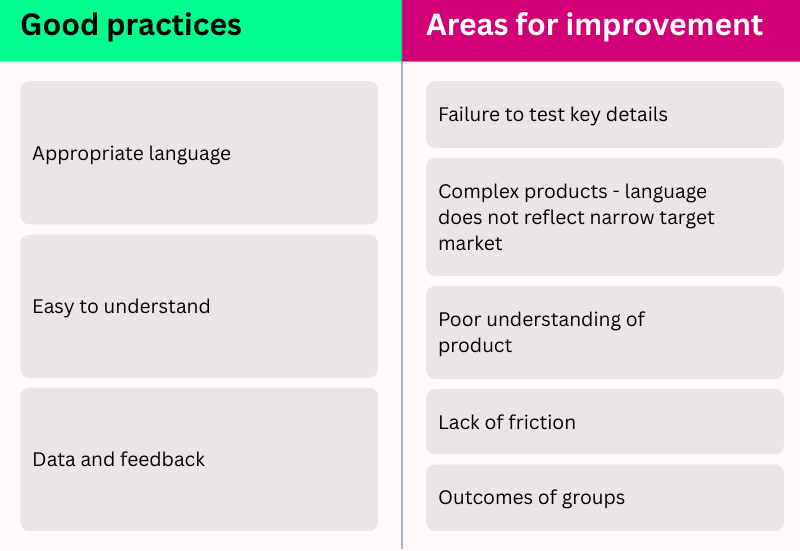

Examples of good practice in this area include:

-

Use of appropriate language – Firms who extensively test the language used in their website, apps, and promotions – feeding this into product design and governance.

-

Easy to understand – Firms that excel in area assess how their communications are understood.

-

Data and feedback – Firms that use quality assurance and data, as well as feedback from frontline agents to improve support and the digital journey.

While areas for improvement included:

-

Failure to test key details such as customer understanding of key product information e.g. fees and features.

-

When simplified language used to does not improve customer understanding, particularly in the case of complex products. Simplicity does not necessarily guarantee clarity.

-

Failure to test whether end-to-end journeys are optimised to ensure customers have the opportunity to view and understand the product fully e.g. when customers cannot view the full page or access different settings.

-

Using testing and assurance activity to better understand the right level of friction needed in digital journeys to ensure that journeys are still efficient but ensure that customers have read and understood the information provided properly.

-

Firms can also test how different customer groups, and their respective journeys, achieve good outcomes.

Discover how Lenvi’s QA team delivers smart, reliable solutions in the delivery of our industry leading software

Management information and oversight

Firms have a duty to monitor and regularly review customer outcomes.

The FCA concluded that digital journeys can support firms in adhering to this due given the significant amounts of data on how customers interact across firms’ apps, websites and financial promotions they produce.

Analytics software can also provide firms with data that gives deep insight into the customer journey. This may include identifying steps on a journey with a high dropout rate (e.g. when customers are required to enter payment details).

In this regard, they found the following areas for improvement for firms:

-

Analyse data on customer journeys - Firms may have access to data that indicates customers are advancing through customer journeys too quickly and not accessing key information, features or help. Analysis of this data could help firms to improve the design of digital journeys and customer outcomes.

-

Use multiple indications to measure success - Firms can be overly reliant on positive online review ratings as an indicator that there are no significant issues and consumers are experiencing good outcomes. While reviews can be a useful indicator, they are unlikely to be sufficient for firms to understand outcomes across their customer base.

Next steps

The FCA have affirmed that they will continue to monitor approaches to digital journeys and app design.

[This page was updated on 1 October, 2025]