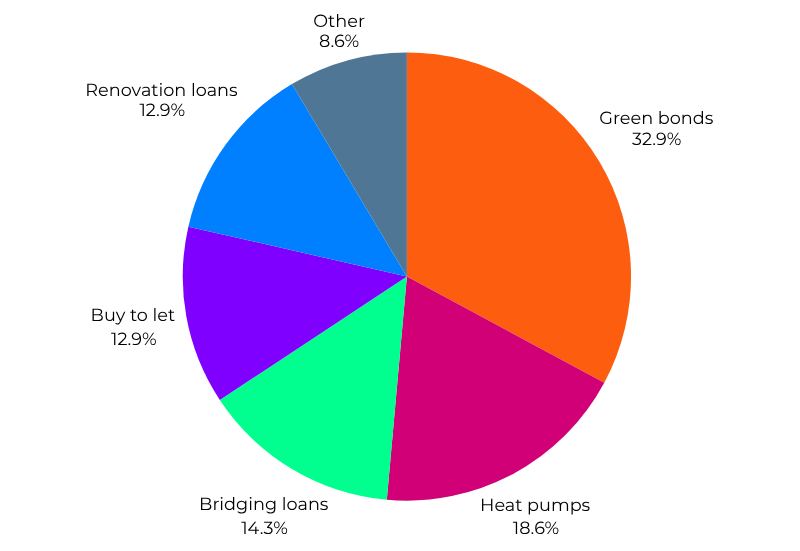

With new products being publicly listed at speed in the EU market, myself and Lenvi Capital Market's team were keen to understand what the next new product that will be brought to market. To get a fair and non-biased opinion we ran a poll among delegates at the 2025 Global ABS and green bonds came out top.

Though this feels somewhat obvious considering the recent trends in sustainable finance, it still feels like a good news story.

An article from the European Environment Agency in late 2024 highlighted the substantial growth experienced in the issuance of green bonds from 2014 – 2023, growing from 0.3% to 6.8%. This growth is predominantly driven through the European Green Deal which emphasises the need for green investments. Therefore, it should be no surprise that Green Bonds are expected to be the next new securitisation product on the EU public markets. With such attentions on this space, if one had been listed, we’d all know about it, right?

A2A Green Bond deal

Since digging into the results further, we found something we find very interesting. In January 2025, A2A placed the first Green Bond deal on the market by a European corporate issuer for €500m. The issuance was warmly welcomed by the market, receiving orders of circa €2bn – an over subscription of 4.4x – a fantastic result, particularly considering it’s the first of its kind.

Not only was this a huge success for A2A, it also emphasises the clear stance Credit Agricole are taking in this area. Credit Agricole were also the book runners on the significant, first-of-its-kind sustainable finance solar panel deal with Enpal in early 2024.

Our poll sought to find out what people in the industry expect the next new product brought to the EU public markets would be. Instead, I’m left asking myself why this success story isn’t as known as it should be. The market and media responses to the Enpal securitisation being the first Solar Panel securitisation was widely acclaimed through multiple media outlets and campaigns, though surprisingly (and I feel verified by the results of the poll), the A2A securitisation publicity falls significantly lighter on presence and I’m left wondering why this might be.

Was it a timing issue? At the time of launch the World was hit by Trumps new tariffs, and the majority of global markets took a hit in one way or another. Therefore, did that overshadow this excellent trade and pass us all by?

20% expect heat pumps to be the new securitisation product to market

Heat pumps came second on the poll with 20% of votes, sentiment that closely follows my own as I do fully expect heat pumps to be publicly listed later in 2026/2027.

It’s a long-held understanding that the EU closely follows the trends seen in US markets and Heat Pumps are still in relative infancy across the pond. Though the tariffs could potentially impact the market further, I still see positive trends in the US for these products as well as the private UK and EU market. Therefore, when that first deal happens (and lets be honest, it should happen in the not too distant future) I wonder if we will see a similar campaign coverage to Enpal, or whether it will slip by the wayside like A2A.

With the strength of sentiment at Global ABS and in broader market commentary toward sustainable products like Green Bonds and heat pumps on the one hand, and the clear lack of market awareness of the A2A deal, I’m left scratching my head. Is the market only looking for certain types of green finance to shout about? Or, as Enpal was the first Solar Panel trade to be public listed and received (and rightfully so) incredible support, has the market already moved on from green finance? My instinct is telling me no. The continued enthusiasm and readiness to champion successful sustainable products suggest that green finance remains a vibrant and essential part of the global market’s future. So, as we move forward, how can we ensure that all innovative green finance initiatives receive the recognition and support they deserve?

I want to emphasise, A2A's first Green Bond deal is a wonderful achievement by the business, bookrunners, and the market, and this is not a meant as a critique of A2A. Instead, this article is intended to serve as an observation of some promising moves in the market. I am very excited to see what Enpal and A2A does next as, if their first public deal in this space is anything to go by, the next one will be even better.

What do you think? I’d love to hear your thoughts.

Find out more about Lenvi's Capital Markets verification services and standby protection